Cover for Profit

Position Cover with a Net profit $ 104,962.00

Net Profit % vs Non-Marginable Securities 6.93%

Net Profit % vs Margin Securities Value 23.10%

Cash Planned for the Investment Marginable Securities $575,000.00

Cash Used Marginable Securities $454,268.00

Non-Marginable Securities $1,514,227.00

IFM changing it is alert for a "buying level",...time to cover,....oK!!!!

The Planned Profit for the 30% and the 50% of the Business Bridget Gap Done,...oK!!!

Keeping the Sell Short Position Open will runing over the evil side!!!!

Low Margin Requirement 30%,...Good for reduce exposure of Capital,...oK!!!!

Trend Performance "Downtrend"

Average Price Paid Must be for a Sell Short Position at 21.04...oK!!!!

Position Average Price Cost at 21.1780,....oK!!!!

Cash Flow at 79%,...oK!!!

Trend Performance "Downtrend"

IFM showing a "buying level",...price target near to be end

Keeping the Sell Short Position Open will runing over the evil side!!!!

Trend Performance "Downtrend"

Average Price Paid Must be for a Sell Short Position at 21.03

Bollinger Bands Moving positive to Keep the oK price in range

Position Average Price Cost at 21.1780

Cash Flow at 79%

IFM showing a "buying level",...price target near to be end

The Planned Profit for the 30% and the 50% of the Business Bridget Gap Done

Keeping the Sell Short Position Open will runing over the evil side!!!!

Scaling Down at 20.83 and 20.50

Business Gap Bridget Updated (new low 19.42) now 11.49%

Planned Profit on Business Gap Updated 3.45%

Resistance Level Updated at 21.18

Self-Correction Level Updated at 20.68

Support Level Updated at 20.18

IFM showing a "buying level",...price target near to be end

Trend Performance "Downtrend"

Average Price Paid Must be for a Sell Short Position at 21.19,....Not oK

Position Average Price Cost at 21.1780,...it should be above 21.19

Cash Flow at 79%

Scaling Down at 21.16

Scaling Down at 21.16

Trend Performance "Downtrend"

Average Price Paid Must be for a Sell Short Position at 21.38,....oK

Position Average Price Cost at 21.4711

Cash Flow at 68.66%

Scaling Down at 21.49 again

Scaling Down at 21.49 again

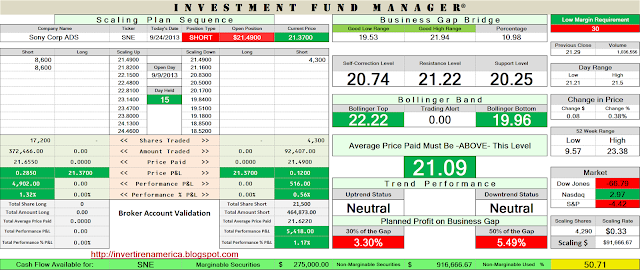

Trend Performance "Neutral"

Average Price Paid Must be for a Sell Short Position at 21.09,....oK

Position Average Price Cost at 21.6220

Cash Flow at 50.71%

Updating Business Gap Bridget and Levels

Scaling Up

Business Gap Bridget Updated (new high 21.94) now 10.98%

Planned Profit on Business Gap Updated 3.30%

Resistance Level Updated at 21.22

Self-Correction Level Updated at 20.74

Support Level Updated at 20.25

Trend Performance "Neutral"

Scaling Up at 21.82

Average Price Paid Must be for a Sell Short Position at 20.97,....oK

Position Average Price Cost at 21.6550

Cash Flow at 40.63%

Updating Business Gap Bridget and Levels

Business Gap Bridget Updated (new high 21.78) now 10.33%

Planned Profit on Business Gap Updated 3.10%

Resistance Level Updated at 21.11

Self-Correction Level Updated at 20.66

Support Level Updated at 20.21

Trend Performance "Uptrend"

Cash Flow at 10.08%

IFM showing "selling level"

Opening Sell Short Position at 21.49

Opening Sell Short Position at 21.49

Business Gap Bridget 9.29%

Planned Profit on Business Gap 2.79%

Low Margin Requirement 30%,...Good for reduce exposure of Capital

Resistance Level at 20.93

Self-Correction Level at 20.53

Support Level at 20.13

Trend Performance "Uptrend"

Average Price Paid Must be for a Sell Short Position at 20.25

Cash Flow at 10.08%

.png)

+Data.png)

No comments:

Post a Comment