Playing with the Indexes (Dow Jones)

Day Held 19

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

Current Profit Performance at 2.85% $1,429.30

Total Amount Marginable Securities Invested $15,526.00

Current Performance base Marginable Invested 9.20%

Total Amount Non-Marginable Invested $50,104.40

Current Performance base Non-Marginable Invested 2.85%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Buying Level"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 53.49 % Cash Flow Ok.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

Price Changed from 12.71 to 13.05

MACD positive area, but in this downside the price will be

moving between SMA-20 and the Bollinger Band Bottom

First Negative Performance,...Sell Short Strong

$MOD Chart 30 minutes

Previous update the MACD decreasing extensively after Five

(5) day of trading.

The price changed between 12.80 to

12.95

MACD positive area and price below the SMA-20, the

performance will be like the 15 minutes chart.

Trend Performance Downtrend.

Price Channel of 12.71 to

13.05

Bollinger Band Day Trading Alert for a Buying Level

I don't see any upside direction, downside on place.

Second Negative Performance Short Trade Better

$MOD Chart 60 minutes

Previously the MACD decreasing extensively, price been

almost during the all day below Bollinger Band Bottom, that

is for me a "trading alert to BUY", next trading the price can

be moving between Bollinger Band Bottom and SMA-20

(13.05)

Trend Performance Downtrend

Strong Price Channel between 12.71 to 13.05 downside

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

The MACD decreasing extensively, the Price is moving

downside below the Bollinger Band Bottom.

The Bollinger Bands increasing the gap from 0.72 on

4/9/2015 to 0.83 today, the averages are working for a big

gap around $1.00 to $2.00

If the Bollinger Band increase to theses gap, the price can

be moving with another 10% discount (11.57).

Fourth Negative Performance, Short Trade Better.

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell

position" after cover it, will go to my Long Position Open at

13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on

12.41, I will keep my short sell open until any upgrade for it.

Price Channel 12.15 to 12.95

Friday, April 10, 2015

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Scaling Down on Sell Short Position

April 10, 2015 Scaling Down on Short Sell Position.

Playing with the Indexes (Dow Jones)

Day Held 16

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

Current Profit Performance at 3.11%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Buying Level"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 43.53 % Cash Flow Ok.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

Previous Update the Price was above the SMA-20, in the opening a very crazy and stupid trader placed an order for Long at 13.39, that was negligent, my advice is avoid "Market order" use "Limited Order"and most my trade is after 11:00 am, never in the opening, I am playing Open and Closed if my Scaling level are meet.

Price Changed from 13.39 to 12.87

MACD positive area, but in this downside the price will be moving between SMA-20 and the Bollinger Band Bottom

Price Channel 12.87 to 3.29 to 13.21 (decreasing extensively)

First Negative Performance Short Trade Better

$MOD Chart 30 minutes

Previous update the MACD decreasing extensively after two (4) day of trading, The price changed between 12.87 to 13.39

MACD negative area and price below the SMA-20, the performance will be like the 15 minutes chart.

Trend Performance around a price channel of 12.87 to 13.07, I don't see any upside direction, downside on place.

Second Negative Performance Short Trade Better

$MOD Chart 60 minutes

Previously the MACD decreasing extensively, price been almost during the all day below Bollinger Band Bottom, that is for me a "trading alert to BUY", next trading the price can be moving between Bollinger Band Bottom and SMA-20 (13.21)

Strong Price Channel between 12.87 to 13.21 downside

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

Previously the MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....and finally the price hit the Bollinger Band Bottom, and now we have a "Trading Alert to BUY" for day trading only.

Overnight Weekend, uhh This Stock been performance pretty close to Market Performance, if Monday it is negative, the stock will swing extraordinarily to the 12.41, if the Market is positive, the price will performance a 13.21 high.

Fourth Negative Performance, Short Trade Better.

Previously, the MACD in a negative area, and the price below to SMA-20,...downside in progress, the Bollinger Band Bottom working as a target, and it was completed.

Previously the Price Channel was 12.41 to 13.52, this is very important to keep up, my "Investment Fund Manager" report 12.82 as a Support Level, and the price channel (low level) is 12.41, the average is showing a price target to exit of my "short sell position" between 12.41 and 12.82.

Support Level around 12.66 is a strong target performance.

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell position" after cover it, will go to my Long Position Open at 13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on 12.41, I will keep my short sell open until any upgrade for it.

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Scaling Down on Sell Short Position

April 9, 2015 Scaling Down on Short Sell Position.

Playing with the Indexes (Dow Jones)

Day Held 15

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Neutral"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 33.51 % Cash Flow Ok.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

Previous Update the Bollinger Band Bottom was crossed, and a "trading alert for BUY" was called, price changed from 13.22 to 13.58 for a Long day trading performance.

MACD positive area, but in this downside the price will be moving between SMA-20 and the Bollinger Band Bottom

Price Channel 13.29 to 13.50 (decreasing extensively)

First Negative Performance Short Trade Better

$MOD Chart 30 minutes

Previous update the MACD decreasing extensively after two (2) day of trading, price moving below Bollinger Band Bottom, that is a "trading alert to BUY". The price changed between 13.22 to 13.58

MACD almost positive and price below the SMA-20, the performance will be like the 15 minutes chart.

Trend Performance around a price channel of 13.22 to 13.48, I don't see any upside direction, downside on place.

Second Negative Performance Short Trade Better

$MOD Chart 60 minutes

Previously the MACD decreasing extensively, price below Bollinger Band Bottom, that is for me a "trading alert to BUY", but a downside trend is in place, price can run downside with the Bollinger Band Bottom for another two (2) more trading days.

The MACD at 4/8/2015 9:30 am hit the 13.58 almost the Bollinger Band Top and drive back to the Bollinger Band Bottom

Strong Price Channel between 13.22 to 13.48 downside

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

Previously the MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

After three Negative Trend Performance, no doubt that Short Sell is appropriate here.

Fourth Negative Performance, Short Trade Better.

MACD in a negative area, and the price below to SMA-20,...downside in progress, the Bollinger Band Bottom working as a target

Previously the Price Channel was 12.41 to 13.52, this is very important to keep up, my "Investment Fund Manager" report 12.82 as a Support Level, and the price channel (low level) is 12.41, the average is showing a price target to exit of my "short sell position" between 12.41 and 12.82.

Support Level at 12.82, this price has been in place for a long time, strong level to show again

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell position" after cover it, will go to my Long Position Open at 13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on 12.41, I will keep my short sell open until any upgrade for it.

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Updating Chart Powered E-trade

April 7, 2015 Upgrading

Playing with the Indexes (Dow Jones)

Day Held 13

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Neutral"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

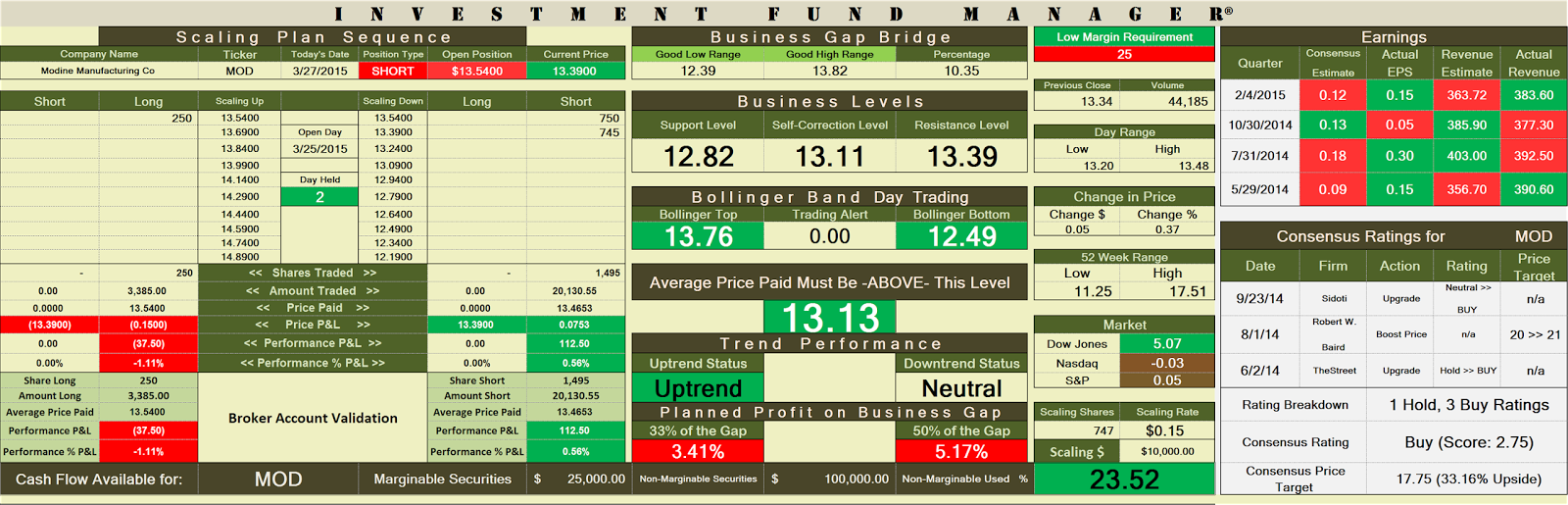

Cash Flow at 23.52 % Cash Flow Ok.

My average still low, my Short Position will be continue and scaling down as the system show for a Day Trading (0.15 cents changed).

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

MACD decreasing extensively, price below Bollinger Band Bottom, for a day trading that is a "trading alert for BUY", but the trending is related to the Market Performance, check both are moving down.

First Negative Performance Short Trade Better

$MOD Chart 30 minutes

MACD decreasing extensively after two (2) day of trading, price moving below Bollinger Band Bottom, that is a "trading alert to BUY".

Trend Performance around a price channel of 13.29 to 13.57, I don't see any upgrade direction, stand by so far.

Two Negative Performance Short Trade Better

$MOD Chart 60 minutes

MACD decreasing extensively, price below Bollinger Band Bottom, that is for me a "trading alert to BUY", but a downside trend is in place, price can run downside with the Bollinger Band Bottom for another two (2) more trading days.

Strong Price Channel between 13.29 to 13.67

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

After three Negative Trend Performance, no doubt that Short Sell is appropriate here.

Fourth Negative Performance, Short Trade Better.

Price Channel 12.41 to 13.52, this is very important to keep up, my "Investment Fund Manager" report 12.82 as a Support Level, and the price channel (low level) is 12.41, the average is showing a price target to exit of my "short sell position" between 12.41 and 12.82.

After this swing my total shares accumulate on "short sell position" after cover it, will go to my Long Position Open at 13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on 12.41, I will keep my short sell open until any upgrade for it.

Playing with the Indexes (Dow Jones)

Day Held 2

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Uptrend"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 23.52 % Cash Flow Ok.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

First Negative Performance Short Trade Better

$MOD Chart 30 minutes

MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

Two Negative Performance Short Trade Better

$MOD Chart 60 minutes

MACD moving up from negative area, as it cross to the positive area, if the price is touching or above the SMA-20, so the price will ahead the Bollinger Band Top,....

Two Negative and First Positive Performance,....

Short Trade Better

$MOD Chart Daily

MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

Three Negative and First Positive Performance,...

Short Trade Better

If the MACD become negative and the price still above the SMA-20, that mean, price will be performance between

SMA-20 and Bollinger Band Top

Next 3 Trade days we are going to see how the market trend line clear.

Opening Long and Short Position

March 25, 2015

Playing with the Indexes (Dow Jones)

Day Held 1

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 13.19

High Range 13.82

Business Bridget Gap Bridget 4.56%

30% of The Planned Profit on Business Gap 1.50%

50% of The Planned Profit on Business Gap 2.28%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.63

Self-Correction Level at 13.51

Support Level at 13.38

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 13.54 % Cash Flow Ok.

No comments:

Post a Comment