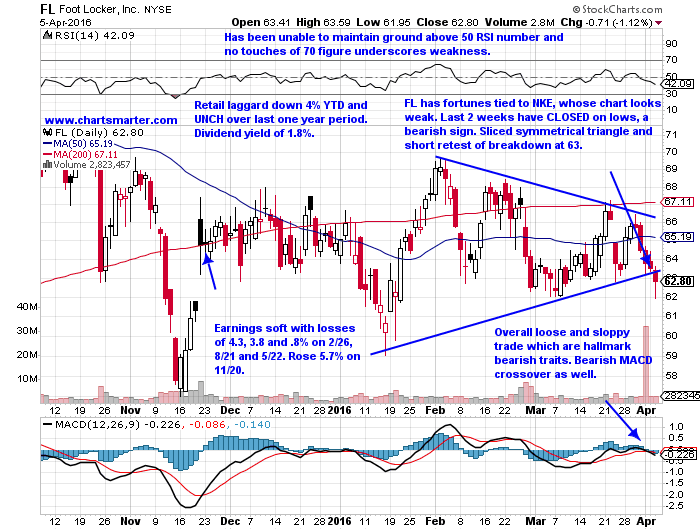

Markets surrendered early gains Monday as the Nasdaq higher by 1% early on gave it back all and closed lower to the tune of .4%. The tech-heavy benchmark for the third consecutive session went out on lows of the day after promising starts and continues to play tug of war between bulls and bears at the 200 days SMA. It did record a bearish MACD crossover last week but does remain in the bullish zone above a 50 RSI number and today was its third consecutive loss to open a week, albeit just marginally (the Nasdaq fell .4 and .1% on 4/4 and 3/28). The S&P 500 continues to act better and after the 5-week winning streak ending between 2/19-3/18 where it rose 9.5% now it looks like it is consolidating that move at the movement. With earnings season upon us starting tonight with AA, it was fitting that the materials sector was the best performer higher by 1.9%. The only other major S&P groups to end higher were energy, financials, and technology. In the energy arena, I found it a bit concerning that many of the very low-quality penny names acted strongly with the likes of BCEI and LGCY up double digits percentage wise. That type of frothiness has to be considered bearish, although oil did finish above the round 40 number today, but the markets ignored the enthusiasm. Consumer names continue to struggle as investor seem to be hoarding cash, with that theme highlighted today by the action in UA, LULU, COST, and FL. Below is the chart of FL and how it was presented in last Wednesdays Game Plan.

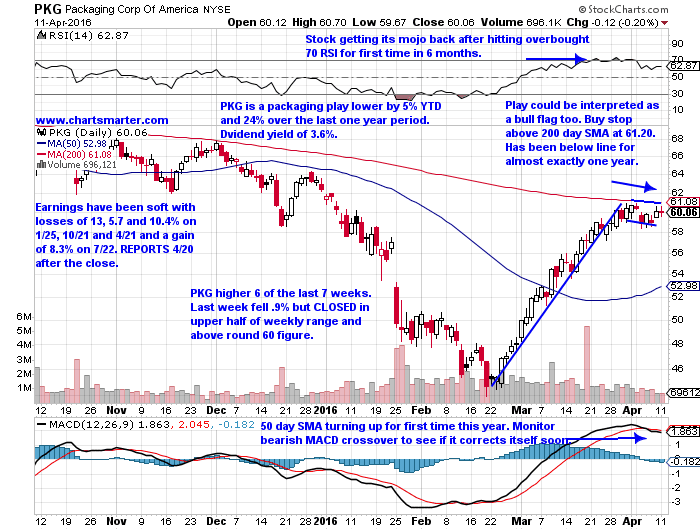

Stocks that can be bought as they take out their 200-day SMAs are PKG. PKG is a packaging play lower by 5% YTD and 24% over the last one year period and sports a nice dividend yield of 3.6%. Earnings have been disappointing with losses of 13, 5.7 and 10.4% on 1/25, 10/21 and 4/21 and a gain of 8.3% on 7/22. The stock is higher 6 of the last 7 weeks with last week down .9% but CLOSED above 60 number and well into upper half of daily range. The 60 number was significant as that was support dating back to October-December '13 and weeks ending 10/17/14 and 10/2/15. It is important that former support does not become resistance. PKG is just below its 200 day SMA and enter with a buy stop above 61.20.

Trigger PKG 61.20. Stop 59.40.

Stocks that can be bought at the round numbers are GWPH. GWPH is a pharma play higher by 15% YTD and lowers by 13% over the last one year period. Earnings have been decent with gains of 7, 3.8 and 1.8% on 2/10, 12/8 and 5/11. It fell 7.1% on 8/6. The stock has had issues since breaking below a rounded top pattern that formed between last April-September at the round par figure on 9/28 losing 8.2% that session. GWPH had lost ground 13 of 15 weeks ending between 12/4-3/11 before the gigantic jump of 120% on 3/14 after good phase 3 results on one of its drugs. It has formed a flag with a nice double bottom at 70 number on 3/16 and 3/31 (no CLOSES below) and is now hovering near the 80 number. Enter with a buy stop above 80.25 and add to through the flag trigger of 84.

Trigger GWPH 80.25. Stop 77.35.

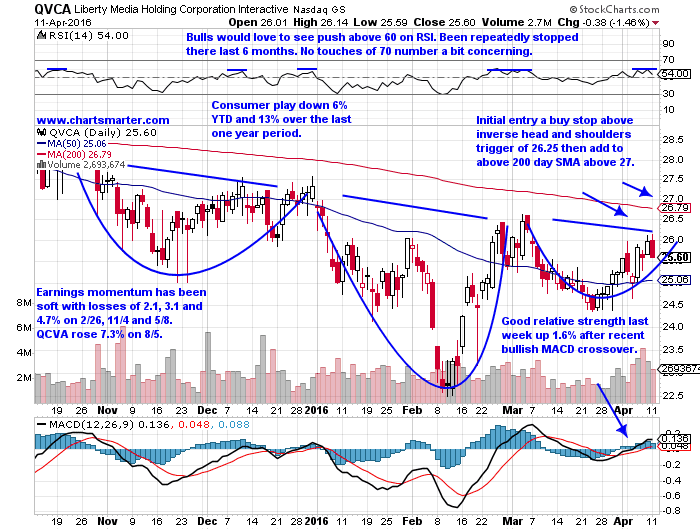

Stocks that can be bought as they take out bullish inverse head and shoulders patterns are QVCA. QVCA is a consumer play down 6% YTD and 13% over the last one year period. Earnings momentum has been soft with losses of 2.1, 3.1 and 4.7% on 2/26, 11/4 and 5/8. QCVA rose 7.3% on 8/5 (it did slump 3.3% the very next session on 8/6). The stock is higher 5 of the last 8 weeks with last weeks 1.6% gain CLOSING at the top of its weekly range showing good relative strength with the benchmarks finishing off more than 1%. QVCA has had issues with the round 30 number with just 3 weekly CLOSES above ending 9/5/14 and 8/7-14/15. It is approaching an inverse head and shoulders trigger and enter with a buy stop above 26.25.

Trigger QVCA 26.25. Stop 25.55.

Stocks that can be bought as they take out the following specific triggers in firm trade are BR SBUX.

Cup with handle trigger BR 59.79. Stop 58.40.

Double bottom trigger SBUX 61.89. Stop 60.45.

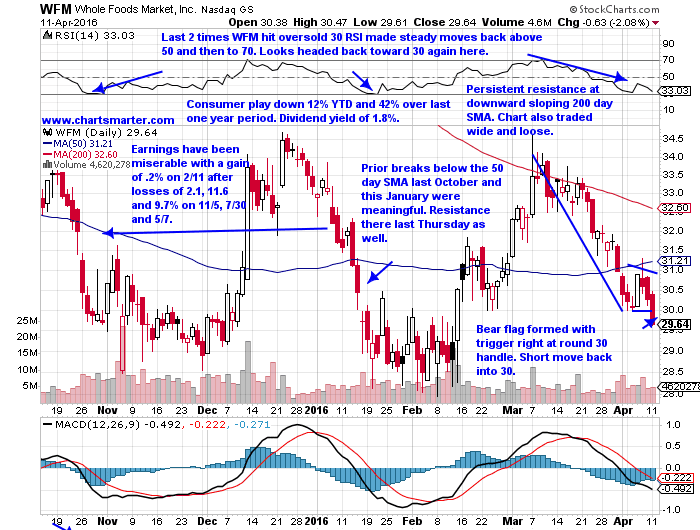

Stocks to be considered shorting opportunities are WFM MD. WFM is a consumer play down 10% YTD and 42% over last one year period and sports a dividend yield of 1.8%. Earnings have been miserable with a gain of .2% on 2/11 after losses of 2.1, 11.6 and 9.7% on 11/5, 7/30 and 5/7. The stock is on a 3-week losing streak losing almost 10% in the process and it is 43% off recent 52-week highs and names that do not rebound in the big recent up move we have had should be put on a sell list. The stock tried to recapture its 50 day SMA last week but was unsuccessful. WFM has formed a bearish flag pattern that formed in conjunction with the round 30 number and broke below it Monday and short move back into at 30.

Trigger WFM 30. Buy stop 31.15.

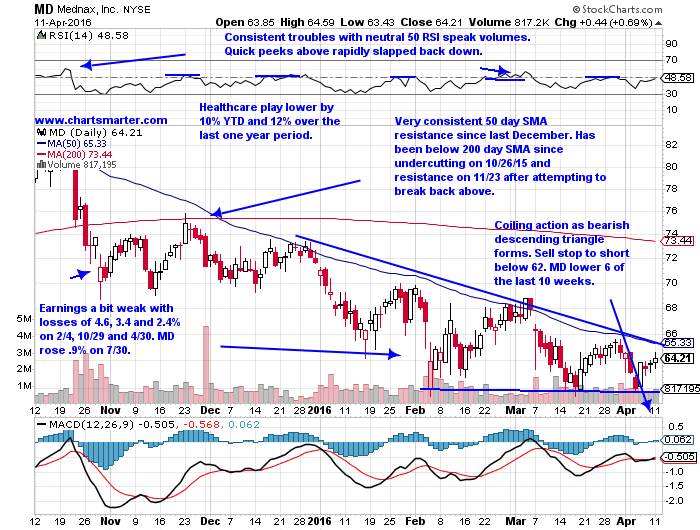

MD is a healthcare play that has not participated in the recent run up in the group and is lower by 10% YTD and 12% over the last one year period. Earnings soft with losses of 4.6, 3.4 and 2.4% on 2/4, 10/29 and 4/30 (the round 70 number was good CLOSING support on the 4/30 and 10/29 sessions). MD rose .9% on 7/30. The stock is lower 6 of the last 10 weeks, a very weak performance and it has not participated in the nascent recovery within the group, a poor sign. MD has formed a bearish descending triangle pattern that began in earnest the week ending 2/5's 6.7% loss. Look to short with a sell stop below the formation at 62.

Trigger MD 62. Buy stop 64.70.

Good luck.

The author owns GLW FLEX.

Trigger summaries:

Buy stop above 200 days SMA PKG 61.20. Stop 59.40.

Buy stop above round numbers GWPH 80.25. Stop 77.35.

Buy stop above inverse head and shoulders pattern QVCA 26.25. Stop 25.55.

Cup with handle trigger BR 59.79. Stop 58.40.

Double bottom trigger SBUX 61.89. Stop 60.45.

A short retest of bear flag breakdown WFM 30. Buy stop 31.15.

Sell stop to short below bearish descending triangle MD 62. Buy stop 64.70.

No comments:

Post a Comment