Las Matematicas en Triangulos, automatizando un sistema de trabajo -Математика на треугольники, автоматизации рабочего системе - 数学成三角形,自动化的工作系统 - Mathematik in Dreiecke, die Automatisierung ein funktionierendes System - الرياضيات في المثلثات، أتمتة نظام العمل - Mathématiques en triangles, l'automatisation d'un système de travail - Matematica in triangoli, l'automazione di un sistema di lavoro - Matemática em triângulos, automatizando um sistema de trabalho - 三角形に数学は、動作中のシステムを自動化する

Showing posts with label Descending Triangles. Show all posts

Showing posts with label Descending Triangles. Show all posts

Thursday, February 8, 2018

Friday, December 15, 2017

$ECA, .....Bearish Descending Triangle

December 15 of 2017

Traders took the price to a technical auto adjustment for the range of 10.16 and 12.98, levels touched in the last 30 days, although the auto adjustment price was at 11.57, SMA-200 pressure at 10.59 moved the exchange up to 11.02

Although 9.6 million shares were exchanged, this volume is not a sign of lengthy adjustments.

After a long overnight session, on Monday we will see opportunities for a comfortable swing trade between 10.85 and 11.57, putting 11.49 as a high resistance level to the rise.

Don't be fooled, 11.49 has a buyer side on the seller of less than 3%, so buyers could move the price up to the SMA-50 of 60 minutes at 11.70 tops.

With 2.1 million shares purchased in the last 15 minutes of trading, Monday's opening will be very volatile, around 11 am will be clearly seen when this small swing will finish resuming the adjustment until 10.61.

With a cost of 11.79 for my short sell, I started to cover this position below 11.32 to 11.23, although I was surprised at 11.02.

My new swing purchase is at 11.28 total cost, which on the 11.49 I will start selling, to restart the last short sell and finish waiting for the next one began from 10.61

although there was a lot of pressure on this sector today, the 52-week record has room to be touched again before the next earnings reports.

December 15 of 2017

With an extraordinary resistance to the rise, the market is showing a technical formation of a descending triangle.

Weekly averages are showing a markedly negative performance.

For this type of weekly average, the price has remained below the SMA-200 which is now 12.17, considering this level a weakness of the price.

For the daily average the SMA-200 is 10.59, now having this formation descending, the price has more than 75% to reach a reduction of up to 10% that places it at 10.61 near the SMA-200.

Traders took the price to a technical auto adjustment for the range of 10.16 and 12.98, levels touched in the last 30 days, although the auto adjustment price was at 11.57, SMA-200 pressure at 10.59 moved the exchange up to 11.02

Although 9.6 million shares were exchanged, this volume is not a sign of lengthy adjustments.

After a long overnight session, on Monday we will see opportunities for a comfortable swing trade between 10.85 and 11.57, putting 11.49 as a high resistance level to the rise.

Don't be fooled, 11.49 has a buyer side on the seller of less than 3%, so buyers could move the price up to the SMA-50 of 60 minutes at 11.70 tops.

With 2.1 million shares purchased in the last 15 minutes of trading, Monday's opening will be very volatile, around 11 am will be clearly seen when this small swing will finish resuming the adjustment until 10.61.

With a cost of 11.79 for my short sell, I started to cover this position below 11.32 to 11.23, although I was surprised at 11.02.

My new swing purchase is at 11.28 total cost, which on the 11.49 I will start selling, to restart the last short sell and finish waiting for the next one began from 10.61

although there was a lot of pressure on this sector today, the 52-week record has room to be touched again before the next earnings reports.

December 15 of 2017

With an extraordinary resistance to the rise, the market is showing a technical formation of a descending triangle.

Weekly averages are showing a markedly negative performance.

For this type of weekly average, the price has remained below the SMA-200 which is now 12.17, considering this level a weakness of the price.

For the daily average the SMA-200 is 10.59, now having this formation descending, the price has more than 75% to reach a reduction of up to 10% that places it at 10.61 near the SMA-200.

My strategy is to keep selling this until I reach the level of 10.61.

Wednesday, December 13, 2017

$ECA, ....Bearish Descending Triangle

With an extraordinary resistance to the rise, the market is showing a technical formation of a descending triangle.

Weekly averages are showing a markedly negative performance.

For this type of weekly average, the price has remained below the SMA-200 which is now 12.17, considering this level a weakness of the price.

For the daily average the SMA-200 is 10.59, now having this formation descending, the price has more than 75% to reach a reduction of up to 10% that places it at 10.61 near the SMA-200.

My strategy is to keep selling this until I reach the level of 10.61.

Tuesday, October 11, 2016

$AMRN, ...Descending Triangle on Daily Chart, Updating

October 14 of 2016

A descending Triangle on Place for Daily Chart Averages (swing trade)

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

- Sixth high at 3.30

- Seventh high at 3.21

- Eighth high at 3.21

- Ninth high at 3.19

- Tenth high at 3.21

- Eleventh high at 3.19

- Twelveth high at 3.16

- Thirteenth high at 3.02

- Fourteenth high at 3.02

- Thirteenth high at 3.02

- Fourteenth high at 3.02

Average at 3.06

Volume decreasing denoting a sell-off mode continue

MACD histogram and line are in the positive area (0.01 from 0.07) territory neutral to negative averages, and the price is moving down.

Aroon Indicator the positive line at 7.14 descending from 21.43 and the negative line 92.86 ascending from 7.14. The Aroon lines are crossed the trend performance will be more extensive and aggressive for the next 15 days.

Aroon Oscillator 14 first day entirely negative at -85.71, this is it, a negative price will continue.

ADX steady at 15.61 from 16.41 moving down indicating the solid performance is making a change to a weak performance or no trading interest.

+DI 15 -DI 15 on a reversal of trend

Top 23.82 from 21.47, Bottom 19.83 from 22.96 we are in cross signal for a negative performance trend.

Stochastic RSI overbought at (fast 0.00 from 46.55) and (slow 42.61 from 71.99)

This combination of this indicator will force the Algorithmics hit the "sell off" orders very soon.

October 12 of 2016

A descending Triangle on Place for Daily Chart Averages (swing trade)

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

- Sixth high at 3.30

- Seventh high at 3.21

- Eighth high at 3.21

- Ninth high at 3.19

- Tenth high at 3.21

- Eleventh high at 3.19

- Twelveth high at 3.16

Average at 3.20

Volume increasing denoting a sell-off mode

MACD histogram and line are in the definite area (0.07 from 0.10) sell level, and the price is moving down.

Aroon Indicator the positive line at 21.43 descending from 28.57 and the negative line from 7.14 to 0.00 also. Almost crossing, and after that, the trend performance will be more extensive and aggressive.

ADX steady at 16.41 from 17.33 moving down indicating the very strong performance is making a change to a weak performance

+DI 15 -DI 15 on a reversal of trend

Top 21.47 from 23.20, Bottom 22.96 from 19.59 we are in cross signal for a negative performance trend.

Stochastic RSI overbought at (fast 46.55 from 69.79) and (slow 71.99 from 80.61)

This combination of this indicator will force the Algorithmics hit the "sell off" orders very soon.

October 11 of 2016

A descending Triangle on Place for Daily Chart Averages with an 90/10 chance (swing trade)

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

- Sixth high at 3.30

- Seventh high at 3.21

- Eighth high at 3.21

- Ninth high at 3.19

- Tenth high at 3.21

- Eleventh high at 3.19

Average at 3.24

Volume also descending

MACD histogram and line are in the positive area (0.10 from 0.13) sell level, and the price is moving down.

Aroon Indicator the positive line at 28.57 descending from 50.0 and the negative line from 7.14 to 0.00 also.

ADX strong at 17.33 from 18.89 moving down indicating the very strong performance is making a change.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 23.20 from 25.52, Bottom 19.59 from 17.68 moving to a change of trend.

Stochastic RSI overbought at (fast 69.79 from 86.50) and (slow 80.61 from 86.50)

This combination of this indicator will force the Algorithmics hit the "sell off" orders very soon.

October 7 of 2016

October 5 of 2016

A descending Triangle on Place for Daily Chart Averages with an 80/20 chance (swing trade)

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

- Sixth high at 3.30

- Seventh high at 3.21

Volume also descending

MACD histogram and line are in the positive area (0.13) sell level, and the price is moving down.

Aroon Indicator the positive line at 50.0 descending from 64.29 and the negative line from 21.43 to 7.14 descending also.

ADX strong at 18.89 up from 18.37 indicating very strong performance.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 25.52 from 25.39, Bottom 17.68 from 16.24 moving to a change of trend.

Stochastic RSI overbought at (fast 86.50 from 86.73) and (slow 86.50 from 88.04)

This combination of this indicator will force the algorithmics hit the "sell off" orders very soon.

October 4 of 2016

A descending Triangle on Place for Daily Chart Averages with an 80/20 chance

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

Volume also descending

MACD histogram and line are in the positive area (0.10) sell level, and the price is moving down.

Aroon Indicator the positive line at 64.29 descending from 78.57 and the negative line from 57 to 21.43 descending also.

ADX strong at 18.37 indicating the downside is in very strong performance.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 25.39 fro 35.20, Bottom 16.24 from 18.47 moving to a negative trend.

Stochastic RSI overbought at (fast 86.73) and (slow 88.04)

This combination of this indicator will force the Algorithmics hit the "sell off" orders very soon.

September 28 of 2016

A descending Triangle on Place with a 60/40 chance

Support level at 3.11

2 High at 3.31 and 2 high at 3.26

Volume also descending

MACD histogram and line are negative also.

Aroon Indicator the positive line at 57.14 descending and the negative line from 87 to 71 descending also.

ADX neutral

Stochastic RSI negative

Thursday, October 6, 2016

$AMRN, ...Descending Triangle on Daily Chart, Updating

October 7 of 2016

October 5 of 2016

A descending Triangle on Place for Daily Chart Averages with an 80/20 chance (swing trade)

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

- Sixth high at 3.30

- Seventh high at 3.21

Volume also descending

MACD histogram and line are in the positive area (0.13) sell level, and the price is moving down.

Aroon Indicator the positive line at 50.0 descending from 64.29 and the negative line from 21.43 to 7.14 descending also.

ADX strong at 18.89 up from 18.37 indicating very strong performance.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 25.52 from 25.39, Bottom 17.68 from 16.24 moving to a change of trend.

Stochastic RSI overbought at (fast 86.50 from 86.73) and (slow 86.50 from 88.04)

This combination of this indicator will force the algorithmics hit the "sell off" orders very soon.

October 4 of 2016

A descending Triangle on Place for Daily Chart Averages with an 80/20 chance

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

Volume also descending

MACD histogram and line are in the positive area (0.10) sell level, and the price is moving down.

Aroon Indicator the positive line at 64.29 descending from 78.57 and the negative line from 57 to 21.43 descending also.

ADX strong at 18.37 indicating the downside is in very strong performance.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 25.39 fro 35.20, Bottom 16.24 from 18.47 moving to a negative trend.

Stochastic RSI overbought at (fast 86.73) and (slow 88.04)

This combination of this indicator will force the algorithmics hit the "sell off" orders very soon.

September 28 of 2016

A descending Triangle on Place with a 60/40 chance

Support level at 3.11

2 High at 3.31 and 2 high at 3.26

Volume also descending

MACD histogram and line are negative also.

Aroon Indicator the positive line at 57.14 descending and the negative line from 87 to 71 descending also.

ADX neutral

Stochastic RSI negative

October 5 of 2016

A descending Triangle on Place for Daily Chart Averages with an 80/20 chance (swing trade)

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

- Sixth high at 3.30

- Seventh high at 3.21

Volume also descending

MACD histogram and line are in the positive area (0.13) sell level, and the price is moving down.

Aroon Indicator the positive line at 50.0 descending from 64.29 and the negative line from 21.43 to 7.14 descending also.

ADX strong at 18.89 up from 18.37 indicating very strong performance.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 25.52 from 25.39, Bottom 17.68 from 16.24 moving to a change of trend.

Stochastic RSI overbought at (fast 86.50 from 86.73) and (slow 86.50 from 88.04)

This combination of this indicator will force the algorithmics hit the "sell off" orders very soon.

October 4 of 2016

A descending Triangle on Place for Daily Chart Averages with an 80/20 chance

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

Volume also descending

MACD histogram and line are in the positive area (0.10) sell level, and the price is moving down.

Aroon Indicator the positive line at 64.29 descending from 78.57 and the negative line from 57 to 21.43 descending also.

ADX strong at 18.37 indicating the downside is in very strong performance.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 25.39 fro 35.20, Bottom 16.24 from 18.47 moving to a negative trend.

Stochastic RSI overbought at (fast 86.73) and (slow 88.04)

This combination of this indicator will force the algorithmics hit the "sell off" orders very soon.

September 28 of 2016

A descending Triangle on Place with a 60/40 chance

Support level at 3.11

2 High at 3.31 and 2 high at 3.26

Volume also descending

MACD histogram and line are negative also.

Aroon Indicator the positive line at 57.14 descending and the negative line from 87 to 71 descending also.

ADX neutral

Stochastic RSI negative

Tuesday, October 4, 2016

$AMRN, ...Descending Triangle on Daily Chart

October 4 of 2016

A descending Triangle on Place for Daily Chart Averages with an 80/20 chance

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

Volume also descending

MACD histogram and line are in the positive area (0.10) sell level, and the price is moving down.

Aroon Indicator the positive line at 64.29 descending from 78.57 and the negative line from 57 to 21.43 descending also.

ADX strong at 18.37 indicating the downside is in very strong performance.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 25.39 fro 35.20, Bottom 16.24 from 18.47 moving to a negative trend.

Stochastic RSI overbought at (fast 86.73) and (slow 88.04)

This combination of this indicator will force the algorithmics hit the "sell off" orders very soon.

September 28 of 2016

A descending Triangle on Place with a 60/40 chance

Support level at 3.11

2 High at 3.31 and 2 high at 3.26

Volume also descending

MACD histogram and line are negative also.

Aroon Indicator the positive line at 57.14 descending and the negative line from 87 to 71 descending also.

ADX neutral

Stochastic RSI negative

A descending Triangle on Place for Daily Chart Averages with an 80/20 chance

Support level at 3.11

- First high at 3.31

- Second high at 3.27

- Third high at 3.25

- Four high at 3.24

- Fifth high at 3.24

Volume also descending

MACD histogram and line are in the positive area (0.10) sell level, and the price is moving down.

Aroon Indicator the positive line at 64.29 descending from 78.57 and the negative line from 57 to 21.43 descending also.

ADX strong at 18.37 indicating the downside is in very strong performance.

+DI 13 -DI 13 moving for weak performance and possible reversal of trend

Top 25.39 fro 35.20, Bottom 16.24 from 18.47 moving to a negative trend.

Stochastic RSI overbought at (fast 86.73) and (slow 88.04)

This combination of this indicator will force the algorithmics hit the "sell off" orders very soon.

September 28 of 2016

A descending Triangle on Place with a 60/40 chance

Support level at 3.11

2 High at 3.31 and 2 high at 3.26

Volume also descending

MACD histogram and line are negative also.

Aroon Indicator the positive line at 57.14 descending and the negative line from 87 to 71 descending also.

ADX neutral

Stochastic RSI negative

Wednesday, September 28, 2016

$AMRN, ...Descending Triangle on 60 minutes chart

September 28 of 2016

A descending Triangle on Place with a 60/40 chance

Support level at 3.11

2 High at 3.31 and 2 high at 3.26

Volume also descending

MACD histogram and line are negative also.

Aroon Indicator the positive line at 57.14 descending and the negative line from 87 to 71 descending also.

ADX neutral

Stochastic RSI negative

A descending Triangle on Place with a 60/40 chance

Support level at 3.11

2 High at 3.31 and 2 high at 3.26

Volume also descending

MACD histogram and line are negative also.

Aroon Indicator the positive line at 57.14 descending and the negative line from 87 to 71 descending also.

ADX neutral

Stochastic RSI negative

Friday, May 1, 2015

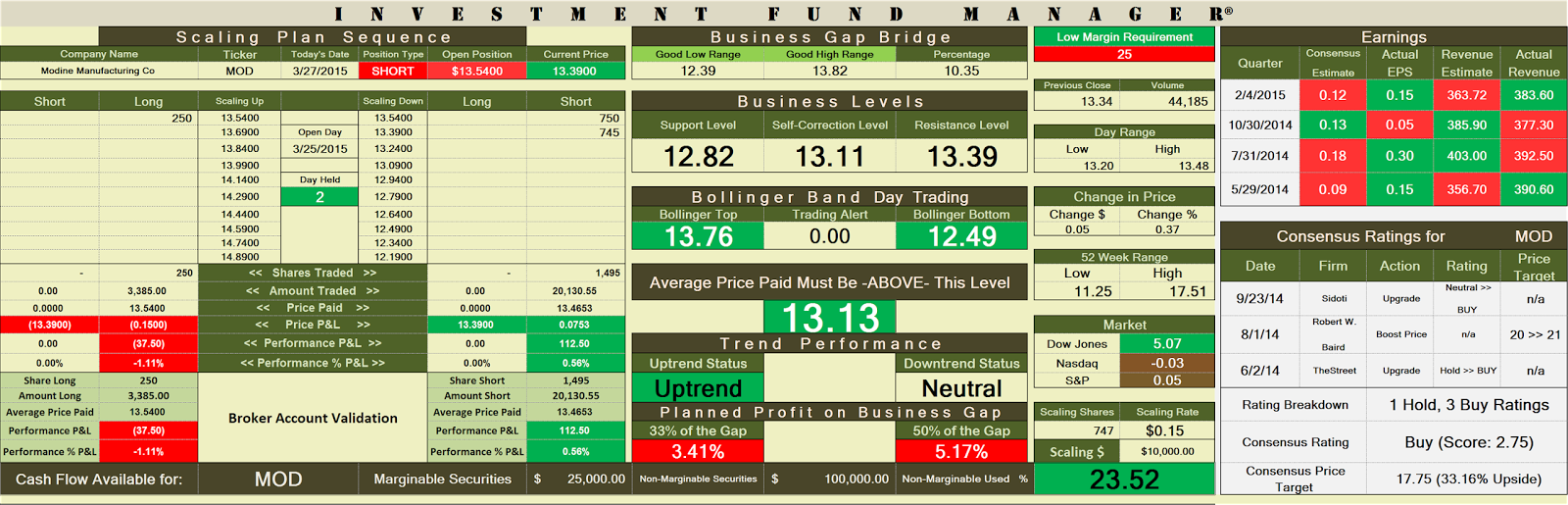

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Descending Triangle Updating

Playing with the Indexes (Dow Jones)

Day Held 37

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 11.37 averages changing a new low range completed on October 30 of 2014

High Range 13.96

Business Bridget Gap Bridget 18.55% Increasing Gap

30% of The Planned Profit on Business Gap 6.12% Increasing the planned Profit

Current Profit Performance at 5.74% $4,331.75

Total Amount Marginable Securities Invested $18,857.35

Current Performance base Marginable Invested 22.97%

Total Amount Non-Marginable Invested $75,429.40

Current Performance base Non-Marginable Invested 5.74%

50% of The Planned Profit on Business Gap 9.28%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.18 decreasing

Self-Correction Level at 12.67 decreasing

Support Level at 12.15 decreasing

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 78.81 % Cash Flow Ok. Scaling Plan Sequence will stop, no more scaling down on Sell Short.

Annualized ROI Performance

The earning season coming on May 26, 2015

and the Market is self-correcting the price level expecting a bad earning call.

The 52 Week Low is 11.25, price will cross that level very soon.

The Bollinger Bands increasing the gap from 0.72 on

4/9/2015 to 1.38 (decreasing from 1.39) today, the averages are working for a big

gap around $1.00 to $2.00.

Fourth Negative Performance, Short Trade Better.

-o-

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell

position" after cover it, will go to my Long Position Open at

13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on

12.41, I will keep my short sell open until any upgrade for it.

Price Channel 11.82 to 1235

As calculated the Price breakout downside yesterday 4/30/2015 looking for a new record

Finally we have a Descending Triangle Breakout Downside as average price surf downside

up to 10%, in this case a 52 week lower record is too near (11.25).

The 52 Week Record's Rule:

When the price cross a 52 Week Record (high/low) it as average breakthrough several time.

MACD, Keeping the negative performance

Negative Performance, the average is not strong

"oversold performance",...but do not call a buy alert here

oversold can be for a few days and weeks, let it go

Traders are "Out of Cash"

80% of them in Long Position with a bad average

Price Paid of 12.81, and that is walking in the

evil side.

The lack of a clear direction, not its was very clear

since April 6 of 2015.

Before the margin call many of traders will increase

the sell off performance, be ready for shopping

spree under 11.50.

Performance after the previous "sell off" day, the traders are making

the right here, please has a seat and wait for a new price term,

my fair price for the stock 9 to 10.5

Wednesday, April 29, 2015

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Descending Triangle on Place

Playing with the Indexes (Dow Jones)

Day Held 35

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.11

High Range 13.96

Business Bridget Gap Bridget 13.25%

30% of The Planned Profit on Business Gap 4.37%

Current Profit Performance at 4.06% $3,059.05

Total Amount Marginable Securities Invested $18,857.35

Current Performance base Marginable Invested 16.22%

Total Amount Non-Marginable Invested $75,429.40

Current Performance base Non-Marginable Invested 4.06%

50% of The Planned Profit on Business Gap 6.63%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.41

Self-Correction Level at 13.04

Support Level at 12.67

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 78.81 % Cash Flow Ok. Scaling Plan Sequence will stop, no more scaling down on Sell Short.

The earning season coming on May 26, 2015

and the Market is self-correcting the price level expecting a bad earning call.

The 52 Week Low is 11.25, price will cross that level very soon.

The Bollinger Bands increasing the gap from 0.72 on

4/9/2015 to 1.39 today, the averages are working for a big

gap around $1.00 to $2.00.

Fourth Negative Performance, Short Trade Better.

-o-

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell

position" after cover it, will go to my Long Position Open at

13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on

12.41, I will keep my short sell open until any upgrade for it.

Price Channel 12.50 to 12.71

Finally we have a Descending Triangle Breakout Downside as average price surf downside

up to 10%, in this case a 52 week lower record is too near (11.25).

The 52 Week Record's Rule:

When the price cross a 52 Week Record (high/low) it as average breakthrough several time.

MACD, keeping the Negative Performance

Negative Performance, the average is not strong

Do not call a "oversold performance",...bad

Traders are "Out of Cash"

80% of them in Long Position with a bad average

Price Paid of 12.94, and that is walking in the

evil side.

The lack of a clear direction, not its was very clear

since April 6 of 2015.

Before the margin call many of traders will increase

the sell off performance, be ready for shopping

spree under 11.50.

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Scaling Down on Sell Short Position at 12.64 and 12.49

Playing with the Indexes (Dow Jones)

Day Held 23

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 11.37 Decreased

High Range 13.96 Increased

Business Bridget Gap Bridget 18.55%

30% of The Planned Profit on Business Gap 6.12%

Current Profit Performance at 4.06% $3,059.05

Total Amount Marginable Securities Invested $18,857.35

Current Performance base Marginable Invested 17.45%

Total Amount Non-Marginable Invested $75,429.40

Current Performance base Non-Marginable Invested 4.36%

50% of The Planned Profit on Business Gap 9.28%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.18 Decreased

Self-Correction Level at 12.67 Decreased

Support Level at 12.15 Decreased

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Buying Level"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 78.81 % Cash Flow Ok. Scaling Plan Sequence will stop, no more scaling down on Sell Short.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

Price Changed from 12.45 to 12.70

Market in Sell Off

First Negative Performance,...Sell Short Strong

$MOD Chart 30 minutes

Previous update the MACD decreasing extensively after Five

(7) day of trading.

The price changed between 12.41 to 12.70

Trend Performance Downtrend.

Price Channel of 12.45 to 12.86

Second Negative Performance Short Trade Better

$MOD Chart 60 minutes

The MACD decreasing extensively, price been

almost during the all day below Bollinger Band Bottom, that

is for me a "trading alert to BUY", next trading the price can

be moving between Bollinger Band Bottom and SMA-20 (12.71)

Bollinger Band Top and Bottom increasing the GAP

Trend Performance Downtrend

Strong Price Channel between 12.71 to 13.05 downside

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

The MACD decreasing extensively, the Price is moving

downside below the Bollinger Band Bottom.

I have to increase the Business Gap Bridge to has updated

the range in a good path. The earning season coming on May 26, 2015

and the Market is self-correcting the price level expecting a bad earning call

The 52 Week Low is 11.25, price will cross that level very soon.

The Bollinger Bands increasing the gap from 0.72 on

4/9/2015 to 1.34 today, the averages are working for a big

gap around $1.00 to $2.00

If the Bollinger Band increase to theses gap, the price can

be moving with another 10% discount (11.57).

Fourth Negative Performance, Short Trade Better.

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell

position" after cover it, will go to my Long Position Open at

13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on

12.41, I will keep my short sell open until any upgrade for it.

Price Channel 12.09 to 12.70

Monday, April 13, 2015

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Scaling Down on Sell Short Position

Playing with the Indexes (Dow Jones)

Day Held 19

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

Current Profit Performance at 2.85% $1,429.30

Total Amount Marginable Securities Invested $15,526.00

Current Performance base Marginable Invested 9.20%

Total Amount Non-Marginable Invested $50,104.40

Current Performance base Non-Marginable Invested 2.85%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Buying Level"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 53.49 % Cash Flow Ok.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

Price Changed from 12.71 to 13.05

MACD positive area, but in this downside the price will be

moving between SMA-20 and the Bollinger Band Bottom

First Negative Performance,...Sell Short Strong

$MOD Chart 30 minutes

Previous update the MACD decreasing extensively after Five

(5) day of trading.

The price changed between 12.80 to

12.95

MACD positive area and price below the SMA-20, the

performance will be like the 15 minutes chart.

Trend Performance Downtrend.

Price Channel of 12.71 to

13.05

Bollinger Band Day Trading Alert for a Buying Level

I don't see any upside direction, downside on place.

Second Negative Performance Short Trade Better

$MOD Chart 60 minutes

Previously the MACD decreasing extensively, price been

almost during the all day below Bollinger Band Bottom, that

is for me a "trading alert to BUY", next trading the price can

be moving between Bollinger Band Bottom and SMA-20

(13.05)

Trend Performance Downtrend

Strong Price Channel between 12.71 to 13.05 downside

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

The MACD decreasing extensively, the Price is moving

downside below the Bollinger Band Bottom.

The Bollinger Bands increasing the gap from 0.72 on

4/9/2015 to 0.83 today, the averages are working for a big

gap around $1.00 to $2.00

If the Bollinger Band increase to theses gap, the price can

be moving with another 10% discount (11.57).

Fourth Negative Performance, Short Trade Better.

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell

position" after cover it, will go to my Long Position Open at

13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on

12.41, I will keep my short sell open until any upgrade for it.

Price Channel 12.15 to 12.95

Friday, April 10, 2015

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Scaling Down on Sell Short Position

April 10, 2015 Scaling Down on Short Sell Position.

Playing with the Indexes (Dow Jones)

Day Held 16

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

Current Profit Performance at 3.11%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Buying Level"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 43.53 % Cash Flow Ok.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

Previous Update the Price was above the SMA-20, in the opening a very crazy and stupid trader placed an order for Long at 13.39, that was negligent, my advice is avoid "Market order" use "Limited Order"and most my trade is after 11:00 am, never in the opening, I am playing Open and Closed if my Scaling level are meet.

Price Changed from 13.39 to 12.87

MACD positive area, but in this downside the price will be moving between SMA-20 and the Bollinger Band Bottom

Price Channel 12.87 to 3.29 to 13.21 (decreasing extensively)

First Negative Performance Short Trade Better

$MOD Chart 30 minutes

Previous update the MACD decreasing extensively after two (4) day of trading, The price changed between 12.87 to 13.39

MACD negative area and price below the SMA-20, the performance will be like the 15 minutes chart.

Trend Performance around a price channel of 12.87 to 13.07, I don't see any upside direction, downside on place.

Second Negative Performance Short Trade Better

$MOD Chart 60 minutes

Previously the MACD decreasing extensively, price been almost during the all day below Bollinger Band Bottom, that is for me a "trading alert to BUY", next trading the price can be moving between Bollinger Band Bottom and SMA-20 (13.21)

Strong Price Channel between 12.87 to 13.21 downside

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

Previously the MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....and finally the price hit the Bollinger Band Bottom, and now we have a "Trading Alert to BUY" for day trading only.

Overnight Weekend, uhh This Stock been performance pretty close to Market Performance, if Monday it is negative, the stock will swing extraordinarily to the 12.41, if the Market is positive, the price will performance a 13.21 high.

Fourth Negative Performance, Short Trade Better.

Previously, the MACD in a negative area, and the price below to SMA-20,...downside in progress, the Bollinger Band Bottom working as a target, and it was completed.

Previously the Price Channel was 12.41 to 13.52, this is very important to keep up, my "Investment Fund Manager" report 12.82 as a Support Level, and the price channel (low level) is 12.41, the average is showing a price target to exit of my "short sell position" between 12.41 and 12.82.

Support Level around 12.66 is a strong target performance.

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell position" after cover it, will go to my Long Position Open at 13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on 12.41, I will keep my short sell open until any upgrade for it.

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Scaling Down on Sell Short Position

April 9, 2015 Scaling Down on Short Sell Position.

Playing with the Indexes (Dow Jones)

Day Held 15

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Neutral"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 33.51 % Cash Flow Ok.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

Previous Update the Bollinger Band Bottom was crossed, and a "trading alert for BUY" was called, price changed from 13.22 to 13.58 for a Long day trading performance.

MACD positive area, but in this downside the price will be moving between SMA-20 and the Bollinger Band Bottom

Price Channel 13.29 to 13.50 (decreasing extensively)

First Negative Performance Short Trade Better

$MOD Chart 30 minutes

Previous update the MACD decreasing extensively after two (2) day of trading, price moving below Bollinger Band Bottom, that is a "trading alert to BUY". The price changed between 13.22 to 13.58

MACD almost positive and price below the SMA-20, the performance will be like the 15 minutes chart.

Trend Performance around a price channel of 13.22 to 13.48, I don't see any upside direction, downside on place.

Second Negative Performance Short Trade Better

$MOD Chart 60 minutes

Previously the MACD decreasing extensively, price below Bollinger Band Bottom, that is for me a "trading alert to BUY", but a downside trend is in place, price can run downside with the Bollinger Band Bottom for another two (2) more trading days.

The MACD at 4/8/2015 9:30 am hit the 13.58 almost the Bollinger Band Top and drive back to the Bollinger Band Bottom

Strong Price Channel between 13.22 to 13.48 downside

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

Previously the MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

After three Negative Trend Performance, no doubt that Short Sell is appropriate here.

Fourth Negative Performance, Short Trade Better.

MACD in a negative area, and the price below to SMA-20,...downside in progress, the Bollinger Band Bottom working as a target

Previously the Price Channel was 12.41 to 13.52, this is very important to keep up, my "Investment Fund Manager" report 12.82 as a Support Level, and the price channel (low level) is 12.41, the average is showing a price target to exit of my "short sell position" between 12.41 and 12.82.

Support Level at 12.82, this price has been in place for a long time, strong level to show again

Triangle performance for a Sell Short Position.

After this swing my total shares accumulate on "short sell position" after cover it, will go to my Long Position Open at 13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on 12.41, I will keep my short sell open until any upgrade for it.

$MOD Day Trading Position Short and Long,....Playing with the Dow Jones,.....Updating Chart Powered E-trade

April 7, 2015 Upgrading

Playing with the Indexes (Dow Jones)

Day Held 13

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Neutral"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 23.52 % Cash Flow Ok.

My average still low, my Short Position will be continue and scaling down as the system show for a Day Trading (0.15 cents changed).

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

MACD decreasing extensively, price below Bollinger Band Bottom, for a day trading that is a "trading alert for BUY", but the trending is related to the Market Performance, check both are moving down.

First Negative Performance Short Trade Better

$MOD Chart 30 minutes

MACD decreasing extensively after two (2) day of trading, price moving below Bollinger Band Bottom, that is a "trading alert to BUY".

Trend Performance around a price channel of 13.29 to 13.57, I don't see any upgrade direction, stand by so far.

Two Negative Performance Short Trade Better

$MOD Chart 60 minutes

MACD decreasing extensively, price below Bollinger Band Bottom, that is for me a "trading alert to BUY", but a downside trend is in place, price can run downside with the Bollinger Band Bottom for another two (2) more trading days.

Strong Price Channel between 13.29 to 13.67

Third Negative Performance, Short Trade Better

$MOD Chart Daily (here is the Big Guy Average)

MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

After three Negative Trend Performance, no doubt that Short Sell is appropriate here.

Fourth Negative Performance, Short Trade Better.

Price Channel 12.41 to 13.52, this is very important to keep up, my "Investment Fund Manager" report 12.82 as a Support Level, and the price channel (low level) is 12.41, the average is showing a price target to exit of my "short sell position" between 12.41 and 12.82.

After this swing my total shares accumulate on "short sell position" after cover it, will go to my Long Position Open at 13.54 improving the average price paid on it.

If the average keep the downtrend performance as now on 12.41, I will keep my short sell open until any upgrade for it.

Playing with the Indexes (Dow Jones)

Day Held 2

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 12.39

High Range 13.82

Business Bridget Gap Bridget 10.35%

30% of The Planned Profit on Business Gap 3.41%

50% of The Planned Profit on Business Gap 5.17%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.39

Self-Correction Level at 13.11

Support Level at 12.82

Trend Performance "Uptrend"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 23.52 % Cash Flow Ok.

How I read Charts:

Avoiding conflict on averages:

$MOD Chart 15 minutes

MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

First Negative Performance Short Trade Better

$MOD Chart 30 minutes

MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

Two Negative Performance Short Trade Better

$MOD Chart 60 minutes

MACD moving up from negative area, as it cross to the positive area, if the price is touching or above the SMA-20, so the price will ahead the Bollinger Band Top,....

Two Negative and First Positive Performance,....

Short Trade Better

$MOD Chart Daily

MACD decreasing, as it cross to the negative area, if the price is touching or below the SMA-20, so the price will ahead the Bollinger Band Bottom,....

Three Negative and First Positive Performance,...

Short Trade Better

If the MACD become negative and the price still above the SMA-20, that mean, price will be performance between

SMA-20 and Bollinger Band Top

Next 3 Trade days we are going to see how the market trend line clear.

Opening Long and Short Position

March 25, 2015

Playing with the Indexes (Dow Jones)

Day Held 1

Long Position Opened with a 1/3 of the Short Position Value, it is moving with the Market Sell Off presion, short position will be closing profits and the total amount of share will be add as scaling on the Long,...the Long position will improve the average price paid intensible.

Low Range 13.19

High Range 13.82

Business Bridget Gap Bridget 4.56%

30% of The Planned Profit on Business Gap 1.50%

50% of The Planned Profit on Business Gap 2.28%

Low Margin Requirement 25%,...Low exposure of Capital

Resistance Level at 13.63

Self-Correction Level at 13.51

Support Level at 13.38

Trend Performance "Downtrend"

Bollinger Band Alert Trading "Neutral"

Cash Marginable Securities $ 25,000.00

Non-Marginable Securities $ 100,000.00

Scaling Rate 0.15 Cents changed

Scaling System Up and Down

Scaling Amount on each level 10,000.00

Cash Flow at 13.54 % Cash Flow Ok.

Subscribe to:

Posts (Atom)